The 10-Second Trick For International Debt Collection

Table of ContentsThe Of Personal Debt CollectionThe 6-Second Trick For Private Schools Debt CollectionThe Ultimate Guide To Debt Collection Agency6 Simple Techniques For Dental Debt Collection

The financial obligation customer purchases only a digital data of details, often without supporting proof of the debt. The financial obligation is also typically older financial debt, sometimes described as "zombie debt" since the financial debt buyer tries to restore a debt that was past the statute of constraints for collections. Financial obligation debt collection agency might contact you either in writing or by phone.

:max_bytes(150000):strip_icc()/when-do-debt-collections-fall-off-your-credit-report-960584-Final-a5e292f44c64429a9290c7967ca77b79.png)

Not talking to them will not make the debt go away, as well as they may simply try alternate methods to call you, including suing you. When a financial debt collection agency calls you, it's vital to get some initial details from them, such as: The debt collection agency's name, address, and phone number. The total quantity of the financial debt they assert you owe, consisting of any kind of fees and interest charges that may have accrued.

What Does Debt Collection Agency Do?

The letter must mention that it's from a debt collector. Name and also resolve of both the financial debt collector as well as the debtor. The creditor or creditors to whom the financial debt is owed. An itemization of the debt, including fees and also rate of interest. They must also notify you of your rights in the financial debt collection procedure, as well as how you can dispute the financial debt.

If you do dispute the financial obligation within thirty day, they should discontinue collection efforts until they give you with proof that the debt is your own. They need to provide you with the name as well as address of the initial creditor if you request that info within 30 days. The financial obligation recognition notice need to consist of a kind that can be used to call them if you wish to contest the financial debt.

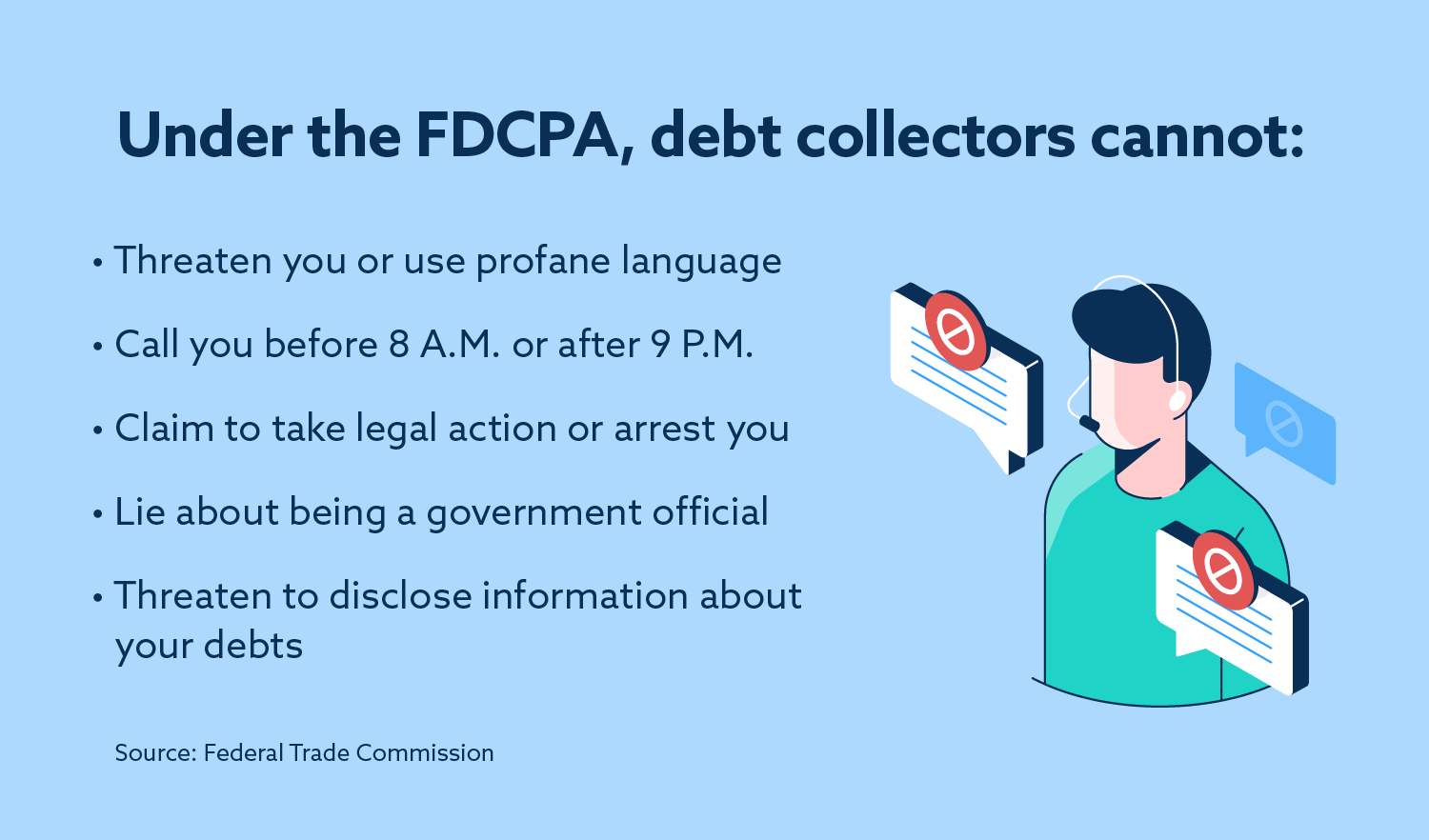

Some points financial obligation collection agencies can not do are: Make repeated calls to a debtor, meaning to irritate the debtor. Normally, unsettled debt is reported to the debt bureaus when it's 30 days past due.

If your financial obligation is transferred to a debt collector or offered to a financial obligation purchaser, an entrance will certainly be made on your credit scores report. Each time your debt is sold, if it continues to go overdue, one more entrance will be included in your credit rating record. Each negative entry on your credit report can remain there for up to 7 years, also after the these details financial obligation has actually been paid.

About Debt Collection Agency

What should you anticipate from a collection company as well as how does the procedure work? Once you have actually made the choice to employ a collection firm, make certain you select the appropriate one.

For instance, some are better at obtaining results from bigger companies, while others are experienced at gathering from home-based companies. See to it you're working with a company that will actually serve your demands. This may appear noticeable, yet prior to you hire a debt collection agency, you need to make sure that they are certified and also certified to act as financial debt enthusiasts.

Before you begin your search, understand the licensing needs for debt collection agency in your state. By doing this, when you are talking go right here to firms, you can talk wisely concerning your state's requirements. Examine with the companies you consult with to ensure they meet the licensing needs for your state, particularly if they lie somewhere else.

You ought to also consult your Bbb and also the Commercial Debt Collection Agency Organization for the names of reliable and extremely related to financial debt collectors. While you may be passing along these financial obligations to a collection agency, they are still representing your firm. You require to understand how they will certainly represent you, exactly how they will certainly deal with you, and what relevant experience they have.

The Best Strategy To Use For Business Debt Collection

Just due to the fact that a method is legal doesn't imply that it's something you want your company name connected with. A reputable debt collection agency will certainly work with you to lay out a strategy you can live with, one that treats your previous clients the means you 'd intend to be dealt with as well as still finishes the job.

If that occurs, one tactic several agencies make use of is avoid mapping. You ought to likewise dig into the enthusiast's experience. Appropriate experience boosts the chance that their collection efforts will be effective.

You must have a point of call that you can communicate with and receive updates from. Business Debt Collection. They must be able to plainly articulate what will be expected from you while doing so, what information you'll need to give, and also what the cadence and also causes for communication will certainly be. Your picked agency ought to be able to accommodate your picked communication demands, not force you to approve their own

No matter view publisher site of whether you win such an instance or not, you wish to make sure that your business is not the one on the hook. Request for evidence of insurance from any debt collector to secure yourself. This is most usually called a mistakes as well as omissions insurance coverage policy. Debt collection is a service, and also it's not an affordable one.